Fintech has come a long way and has evolved rapidly, driven by a strong market. In its growth, mobile banking apps have become a strong pillar and an essential tool for global customers to manage their finances from anywhere.

Smart banking apps offer seamless payment options, AI-driven insights and are redefining convenience for banking. As the demand for such tools is growing among customers, many fintech businesses are investing in their creation.

If you are planning to create one, you must learn about the features and benefits a mobile banking app offers. So, we created this guide, in which you can navigate through the best 15+ names of the best apps for online banking.

Keep with this blog till the end.

Best Mobile Banking Apps of 2026

We have covered the best banking apps in the list mentioned below, but before getting into them, you should have a brief understanding of what a mobile banking app.

A mobile banking app can be defined as a smartphone application that makes banking easier by letting customers dodge traditional bank visits. It is a quicker and more secure way to manage finances from anywhere and at any time.

These apps let anyone check account balances, transfer money, pay bills, deposit cheques, and manage their cards. Mobile banking apps protect the personal details of users through security features like biometric authentication, encryption, and real-time alerts.

We have also covered a few interesting statistics on mobile banking apps that need your attention to know about their growing impacts.

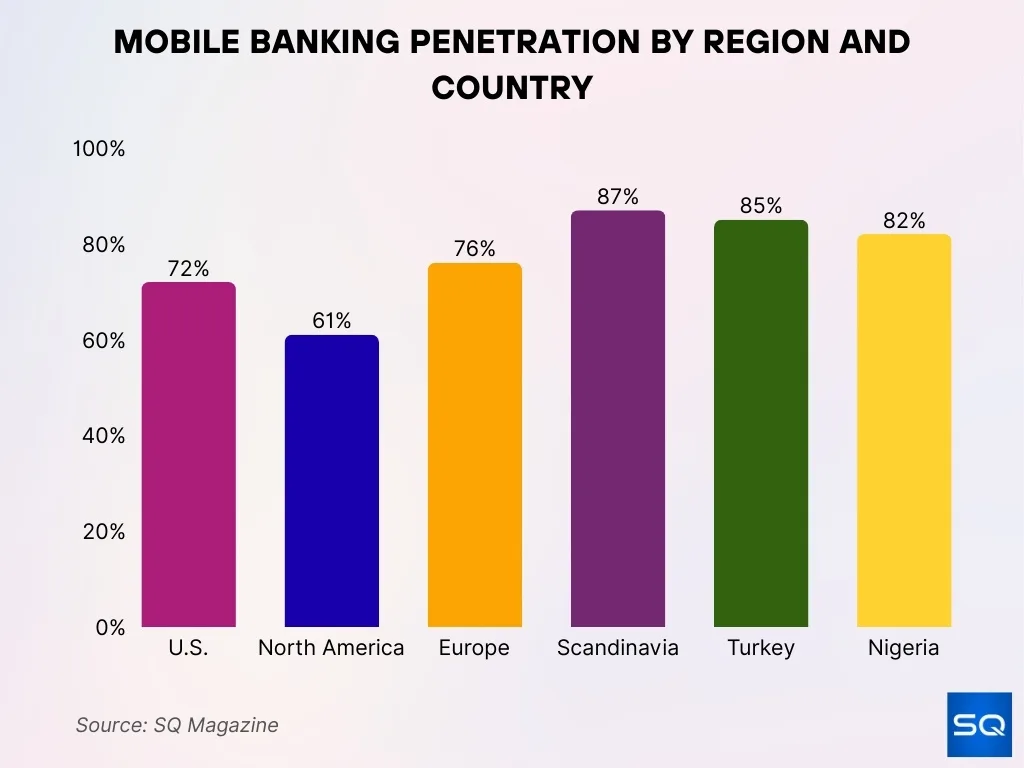

- In 2025, 72% of adults in the U.S. use mobile banking apps, which was once 65% in 2022.

- In 2023, digital banking was used by 66% of people, and it is expected that by 2029, it will increase and reach 79%.

- It is expected that by the end of 2025, mobile banking will be used by 2.17 billion people globally. This will increase by 35% from 2020.

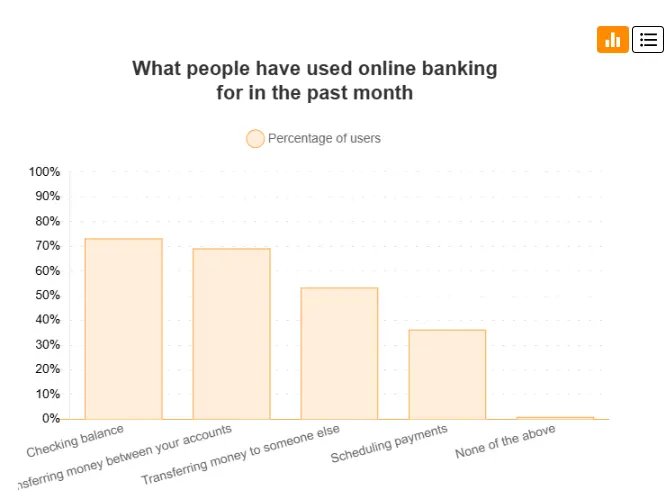

- 73.2% of people prefer to use digital banking services to check their balance, and 69.2% use them to transfer money.

- 64% of adults in the U.S. choose mobile banking over the traditional banking system.

- It is expected that by the end of 2025, 89% of the banks globally will launch mobile banking apps.

As technological transformation sweeps through the financial industry, mobile banking apps have become essential tools for managing finances. This has encouraged many fintech businesses to invest in the creation and launch of the best mobile banking apps.

| Apps | Available On | Downloads | Ratings |

| Bank of America Mobile Banking | Android & iOS | 50M+ | 4.8/5 & 4.8/5 |

| Chase Mobile | Android & iOS | 50M+ | 4.7/5 & 4.8/5 |

| Revolut | Android & iOS | 50M+ | 4.7/5 &4.7/5 |

| Discover Mobile App | Android & iOS | 10M+ | 4.8/5 & 4.9/5 |

| Wells Fargo Mobile | Android & iOS | 10M+ | 4.8/5 & 4.9/5 |

| Capital One Mobile | Android & iOS | 10M+ | 4.6/5 & 4.9/5 |

| BBVA Mobile Banking | Android & iOS | 10M+ | 4.6/5 & 4.8/5 |

| USAA Mobile Banking | Android & iOS | 10M+ | 4.3/5 & 4.8/5 |

| Chime Mobile Banking | Android & iOS | 10M+ | 4.3/5 & 4.8/5 |

| Monzo Bank- Mobile Banking | Android & iOS | 10M+ | 4.7/5 & 4.8/5 |

| Citi Mobile | Android & iOS | 10M+ | 4.5/5 & 4.9/5 |

| N26- Love Your Bank | Android & iOS | 10M+ | 4.0/5 & 4.6/5 |

| Bank Millennium | Android & iOS | 5M+ | 4.7/5 & 4.8/5 |

| Santander Mobile Banking | Android & iOS | 5M+ | 4.6/5 & 4.8/5 |

| PNC Mobile Banking | Android & iOS | 5M+ | 4.8/5 & 4.9/5 |

| Varo Bank | Android & iOS | 5M+ | 4.9/5 |

| Fifth Third Bank Mobile Banking | Android & iOS | 1M+ | 4.3/5 & 4.8/5 |

To study which apps give the best outcomes and understand their function, you must read the list of the best online banking apps below that we have discussed.

Let’s get started.

1] Bank of America Mobile Banking

The Bank of America Mobile Banking app is one of the widely used mobile banking apps in the U.S., offering a range of great features. This app was created to provide a convenient and secure banking solution that can be accessed virtually from anywhere.

It is available for both iOS and Android devices, which integrate essential banking tools, advanced security features, and intelligent financial insights. The app is a comprehensive financial tool for managing money, planning long-term finances, and making fast transactions.

Key Features:

- Account Management

- Strong security measures

- Erica, virtual financial assistant

- Mobile cheque deposit

- Bill Pay

- Zelle integration

2] Chase Mobile (JPMorgan Chase)

Chase Mobile is the online banking app officially launched by JPMorgan Chase, recognized as one of the largest banks in the United States. This comprehensive financial tool was created to help users manage a wide range of personal financial accounts.

Chase Bank’s mobile app offers services that make everyday banking, credit card management, investment, and loan services easier. It is famous for its intuitive user interface, specially designed to let users enjoy fast navigation.

Key Features:

- Chase credit card management

- Mobile cheque deposit

- Chase Quick Pay and Quick Transfer

- Credit score monitoring

- Budgeting and financial insights

- Zelle integration

3] Revolut

Revolut is a globally recognised fintech company that offers the best mobile banking features through its robust mobile app. This app is a complete package; it lets users make payments (NFC), convert currencies, trade cryptocurrencies, use budget tools, and more.

This online banking app follows a modern approach that can play the role of flexible currency tools, help users manage money, and offer transparent pricing. This has become a popular choice of apps among travelers, freelancers, digital nomads, and others.

Key Features:

- International spending & travel tools

- Revolut cards

- Multi-currency accounts

- Money transfer

- Investing features

- Savings and smart money tools

4] Discover Mobile App

Discover Mobile App, the all-in-one digital banking solution created by Discover Financial Services, is one of the highly rated and secure banking applications. This allows users to conveniently manage their Discover credit cards and bank accounts from anywhere.

The app has secured the top position among all other apps because of its simplicity and user-friendly design. Discover supports several features in addition to Discover credit cards, including banking products, personal loans, and student loans, all in one place.

Key Features:

- Mobile cheque deposit

- Budgeting tools

- Zelle integration

- Credit card account management tools

- Reward tracking

- Credit score monitoring

5] Wells Fargo Mobile

Wells Fargo Mobile is one of the top-rated mobile banking apps offering excellent services to personal and small business customers. Users of this app can manage their finances, make seamless payments, and access financial tools right from their smartphones.

For individuals looking for a flexible mobile banking tool powered by the major national institutions, Wells Fargo is the ultimate choice. The primary reason for this app getting constant praise is because of its ease of use and the extensive features it offers.

Key Features:

- Zelle payments

- Bill pay functionalities

- Mobile cheque deposit

- Advanced security features

- Cards and Account Management

- Credit score monitoring

- Financial tools

6] Capital One Mobile

Capital One Mobile is a powerful online banking platform created for individuals who want to manage their bank accounts at their fingertips. This app comes with multiple functionalities, allowing users to manage Capital One credit cards, bank accounts, and auto loan accounts.

Clean interface, real-time alerts, and strong security have made this online banking platform a popular choice among customers over time. The app gets updates very frequently, which keeps introducing new tools to fulfill the customer’s needs and to stay competitive.

Key Features:

- Credit monitoring

- Strong security features

- Account management

- Bill pay and mobile cheque deposit

- Card management and security

- Eno virtual assistance

7] BBVA Mobile Banking

BBVA Mobile Banking is an award-winning online banking app famous for its user-friendly design, innovative features like AI-powered assistance, and financial health tools. This app is a popular choice for individuals who want to access their financial accounts on the go.

For everyday banking transactions, this app is the ideal one; it also helps users to keep track of their financial transactions. Users of the BBVA Mobile Banking app can make secure payments with the Aqua Card, transfer money, and also make the right investments.

Key Features:

- Manage cards

- Mobile cheque deposit

- Money transfers and payments

- AI-powered assistance

- Smart Discreet Mode for privacy

- Product and Service Management

8] USAA Mobile Banking

USAA Mobile Banking is a digital banking app designed specifically for military members and their families. The app aims to provide convenient and secure solutions, including insurance, investment, and banking, from anywhere on smartphones.

This mobile banking app has no physical branches and is specially made for those stationed abroad, operating completely relying on its robust online and mobile presence. USAA Mobile Banking also provides budgeting tools and financial advice as per the needs of users.

Key Features:

- Card Management

- Money transfer and payments

- Mobile cheque deposit

- Budgeting tools

- Strong security

- Support and military-focused services

9] Chime Mobile Banking

Chime is a complete solution that offers its users access to banking services, credit management, advanced cash, easy savings options, and more. It is in partnership with FDCI, insured banks that offer secure and accessible banking services with no hidden charges.

This is one of the best mobile banking apps that offers intuitive tools to its users to plan budgets, make payments, save, and daily account management. Chime Mobile Banking is very easy to use because of its clean interface, large icons, and intuitive navigation.

Key Features:

- Fee-free banking

- Early direct deposit access

- SpotMe overdraft protection

- Credit builder secured card

- Automatic saving tools

- Fee-free ATM network

10] Monzo Bank- Mobile Banking

Monzo Bank is popular as one of the leading online banking apps in the UK that lets users access complete banking services through their smartphone. This app prioritizes convenience, transparent fees, and built-in financial tools that have gained it millions of customers.

The bright coral debit card and sleek interface of the Monzo Bank app are another reason for it to become a favorite resort over traditional banking. Monzo Bank gets regular updates about the secret of its continuous performance improvements and achieving the modern digital bank.

Key Features:

- Saving pots

- Split bills & group expenses

- Fee-free travel expenses

- Spending insights and budgeting tools

- Real-time account management

- Monzo plus and Monzo premium

11] Citi Mobile

Citibank Mobile app is a fully featured online banking platform powered by the famous Citibank. The main aim of a modern banking app is to offer customers fast, secure, and convenient access to accounts without the hassle of a physical bank visit.

This app has a streamlined and easy-to-navigate interface that offers users a range of services that revolve around everyday banking, credit cards, lending, and financial insights. So, the customers of Citibank can manage their finances from anywhere and at any time.

Key Features:

- Mobile cheque deposit

- Card security controls

- Bill pay and money transfers

- Citi Quick Lock and virtual cards

- Access to credit scores

- Special insights and budgeting tools

12] N26- Love Your Bank

N26 is the licensed mobile banking app of the German Digital Bank and is popular for being the leading European mobile bank. This online banking app aims to transform the way people manage their finances by offering a modern, intuitive, and seamless banking experience.

Users of N26 will get a sleek app that offers instant insights into their financial transactions, and that too without any hidden fees. N26 makes everyday savings simple, helping users to plan savings goals and make international payments a hassle-free action while travelling.

Key Features:

- Free P2P transfers with MoneyBeam

- N26 Spaces for savings & budgeting

- Categorise spending automatically

- Mobile payments

- International Money Transfer

- N26 Debit Mastercard

13] Bank Millennium

The Millennium mobile banking app is by Bank Millennium, one of Poland’s leading financial institutions. This app offers the perfect solution to customers looking for a platform that can manage everyday finances seamlessly.

Bank Millennium is a powerful payment solution that also comes with strong security, flexible card management, a financial planning tool, and other features. It is a popular choice among customers because it makes banking simple, safe, and highly convenient.

Key Features:

- Fund transfer

- Cash operations

- Intuitive account management

- Loans and credit services

- Fast and flexible payments

- Mobile authentication and safety

14] Santander Mobile Banking

The Santander mobile banking app provides its reliable banking services to both personal and business users. It aims to offer esteemed customers access to finances anywhere and anytime in a simple, secure, and convenient way through a customer-centric app.

Everyday banking, budgeting and account management are easy tasks with the wide range of tools Santander mobile banking apps offer. Santander is committed to bringing digital innovation through its app that offers fast payments, strong security, and helpful financial insights.

Key Features:

- Mobile cheque deposit

- Bill pay & Money transfers

- Spending insights & Budgeting tools

- Strong security measures

- Compatible with digital wallets

- Loan and Mortgage Management

15] PNC Mobile Banking

The PNC mobile banking app offers an innovative solution with Virtual Wallets, a money management system that lets customers organize, track, and improve spending habits. This digital banking app is also famous for its strong security features and diverse payment options.

Among the regional banks of the U.S., this app is the most comprehensive solution. This app makes the banking experience more interactive and intuitive through its Virtual Wallet’s visualization tools, including charts, a calendar, and timelines.

Key Features:

- Virtual Wallet- the financial tools

- Mobile cheque deposit

- Bill pay and Zelle® payments

- Locator services

- Budgeting tools and expense tracking

- Personalized financial insights

16] Varo Bank

Varo Bank is a digital-first financial product that has no physical bank, but is an FDIC-insured online platform that can be operated through smartphones. Varo is one of the highly rated banking apps that focuses on offering convenience, low fees, and easy money management.

Customers can use this app effortlessly as their full banking solution, as it provides helpful financial insights and intuitive controls. This online banking app stands out as one of the strongest mobile-first banks available in the entire U.S. market

Key Features:

- Fee-free banking

- FDIC insured

- High-yielding savings account

- Early direct deposit access

- Spending insights and Budgeting tools

- Powerful money transfer options

17] Fifth Third Bank Mobile Banking

Fifth Third Bank is a famous mobile banking app known for the convenience it offers to its customers by letting them manage their finances from anywhere and at any time. This app ends the stress for the customers that comes with every physical bank visit.

Rich financial tools are integrated in this modern online banking app that allows its users to manage accounts, make payments, deposit cheques, and track spending seamlessly. Along with modern technology, this leading banking app offers strong customer support.

Key Features:

- Fifth Third Momentum banking tools

- Mobile cheque deposit

- Bill pay and Zelle payments

- Person-to-person transfers

- Financial Management Tools

- Strong security measures

Nimble AppGenie Can Create the Next Top Mobile Banking App For You

Want to stay ahead of the growing competition in the fintech industry? Investing in the development of a robust mobile banking app can be an impactful step.

To help you in this journey, Nimble AppGenie will be the perfect companion by making the whole development process more seamless. We are renowned for being a globally recognized and innovative mobile banking app development company.

Nimble AppGenie brings over 8 years of hands-on app development experience for several industries, including fintech. We strive to deliver high-quality, customized, and innovative apps tailored to our esteemed clients’ business needs.

So, with us, create a mobile banking app that thrives and offers the best online banking services to its users.

Conclusion

So, you see, when innovation, security, and user-focused design come together, it can create top fintech apps, and the above 15+ apps are the visible proof. All of them have set the standard for convenience and trust in the online banking landscape.

The top-notch performance and excellent features of the above-mentioned apps have encouraged many fintech businesses to invest in a mobile banking app.

Now is your time to invest in a mobile banking app that not only competes with today’s best but defines tomorrow’s expectations.

FAQs

A top mobile banking app should include key features that make banking easier and more efficient. Essential features include:

- Intuitive interface

- Quick peer-to-peer transfers

- Budgeting tools

- Mobile cheque deposit

- Robust security measures

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.