Apps like Revolut are changing the way we handle money.

From applying for loans to sending money to your friends, mobile banking apps enable everything. And people love it!

But there must be more mobile banking apps, right? Yes! There are. If you are someone who is looking for banking apps like Revolut, this blog is for you.

Whether you are someone who wants to use an app like Revolut or just want to learn more about neo-banking apps, read till the end.

Here, we shall be discussing the rise of banking apps, a brief overview of Revolut, and more popular apps like Revolut.

Best Apps Like Revolut: Chime, MoneyLion, & More

Look for other Revolut alternatives. Well, we have plenty!

Here, we shall be discussing market-leading neo-banking apps like Revolut and its alternatives.

So let’s get right into it, starting with:

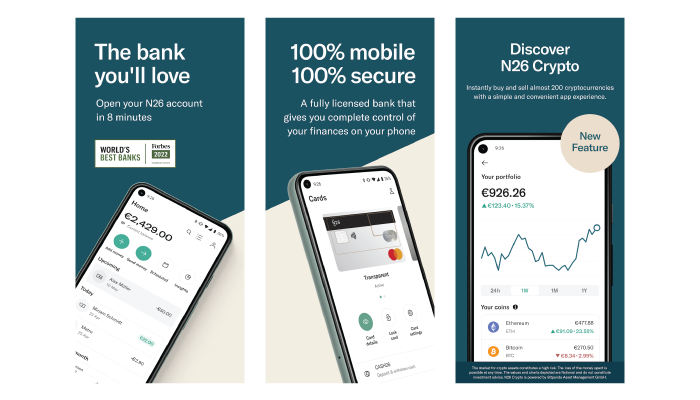

1. N26 – Neo Banking App

Imagine having a personal banker at your fingertips, ready to assist you on your financial adventures.

Well, that’s exactly what N26 brings to the table.

Equipped with a sleek mobile banking app, N26 offers a host of features that will make you feel like a financial connoisseur.

From a free debit card that saves you from dastardly foreign transaction fees to intuitive budgeting tools that help you track your spending, N26 ensures you stay in control of your finances.

So, whether you’re navigating the bustling streets of Tokyo or sipping espresso in a quaint Parisian cafe, creating an app like N26 is the trusty sidekick you need.

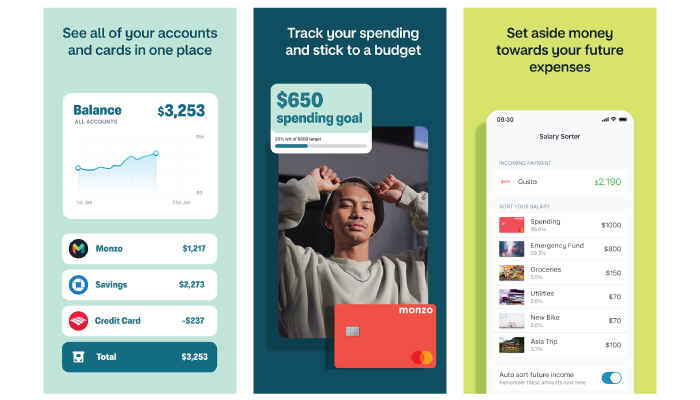

2. Monzo – New Age Bank

Are you tired of traditional banks and their antiquated ways? Well, then this is the mobile banking app for you!

Monzo, with its bright coral-coloured card and modern mobile banking app, is all about making finance fun and easy.

Now, picture this: instant spending notifications that pop up on your phone as you swipe your card, helping you stay on top of your transactions in real-time.

And with zero foreign transaction fees, Monzo becomes the ideal travel companion, freeing you from the clutches of those pesky fees that drain your wallet.

You get all of this with a market-leading neo banking app. You can embrace the Coral Revolution and let Monzo revolutionize your financial journey.

Also Read: Cost to Develop an App Like Monzo

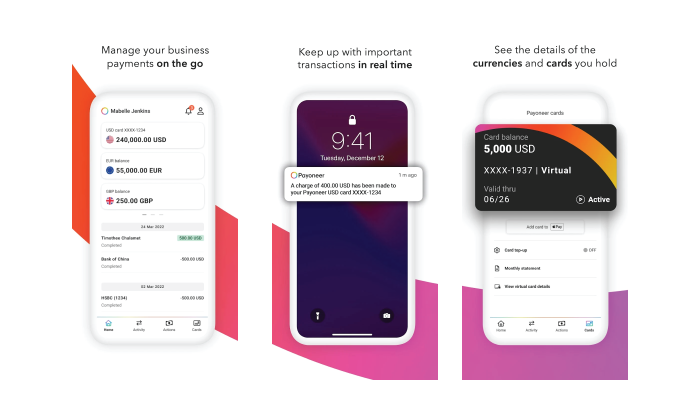

3. Payoneer – Pioneering Online Payment

Have you ever heard of Payoneer? You must have!

In a world where borders are merely lines on a map, Payoneer steps in to connect people across the globe.

With its virtual hands reaching out to both individuals and businesses, Payoneer simplifies international payments like a true globetrotting guru.

Need to receive funds from a client in a foreign land? No problem! Payoneer’s global payment services and prepaid Mastercard have got you covered.

It’s like having your very own magic carpet ride, transporting your money securely and swiftly to wherever it needs to go.

Let Payoneer be your trusted genie, granting your international payment wishes.

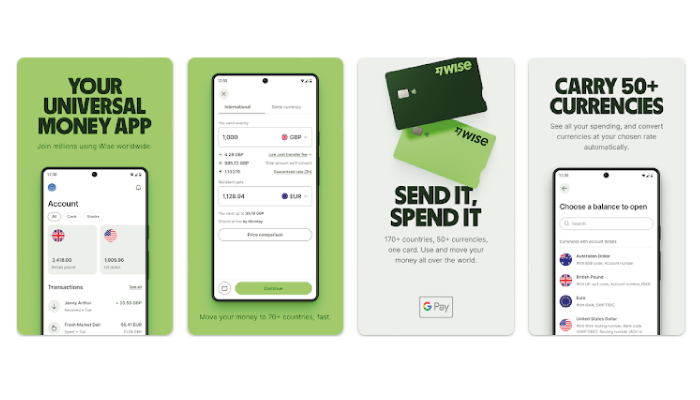

4. Wise (formerly known as TransferWise)

Wise, the chameleon of banking apps, adapts to your every need.

With its multi-currency accounts and borderless functionality, Wise allows you to effortlessly juggle currencies like a skilled circus performer.

This market-leading mobile banking app will help you say goodbye to the frustration of dealing with multiple bank accounts for different currencies. This is what makes it a leading app like Revolut.

Wise lets you hold and convert money in different currencies, ensuring you’re always in control of your global finances.

And with its Wise debit card, you can spend like a local wherever you go. It’s financial flexibility at its finest.

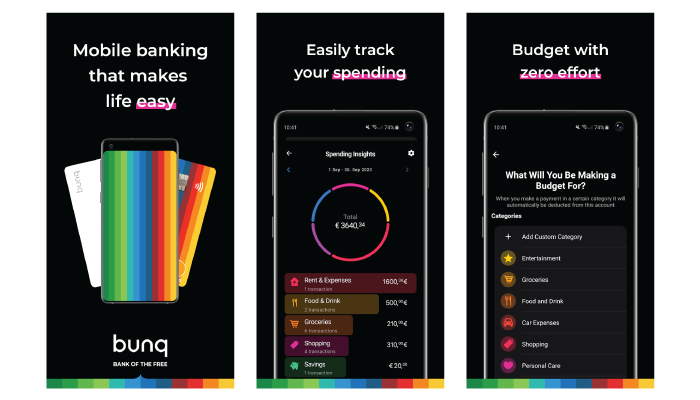

5. Bunq

Bunq is a good example of what a mobile banking app can be.

With its vibrant orange interface and an array of features, Bunq empowers you to take charge of your financial destiny.

Fancy setting up multiple accounts for different purposes? Bunq lets you do just that, ensuring you stay organized and focused on your financial goals.

Plus, with real-time notifications, you’ll always be in the loop about your transactions, making budgeting a breeze.

So, if you are someone who is looking for mobile banking apps or market-leading apps like Revolut, this is the one that you should not miss.

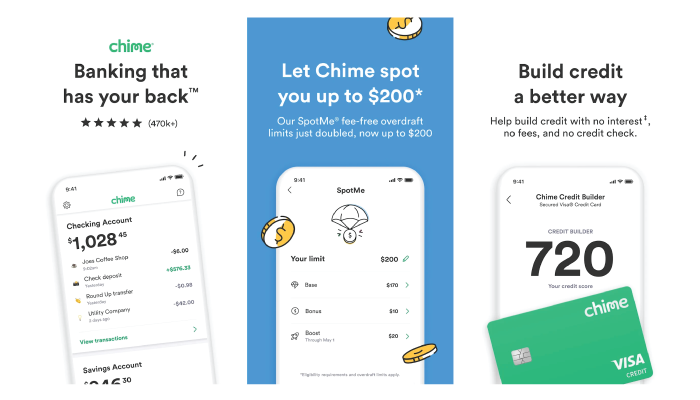

6. Chime – Best Mobile Banking App

If you are looking for another Revolut alternative app, you shouldn’t miss Chime.

This mobile banking app has a refreshing approach, making you feel like a valued member of a community rather than a faceless customer.

Plus, Chime showers you with perks like early direct deposit, ensuring you get your hard-earned money before everyone else.

With no monthly fees, you can bid adieu to those pesky charges that eat away at your savings. It’s time to join the Chime Revolution and reclaim your financial freedom.

All in all, this is a market-leading platform that everyone looking for a list of neobanking should definitely check out!

Also Read: Know the Cost to Develop an App Like Chime

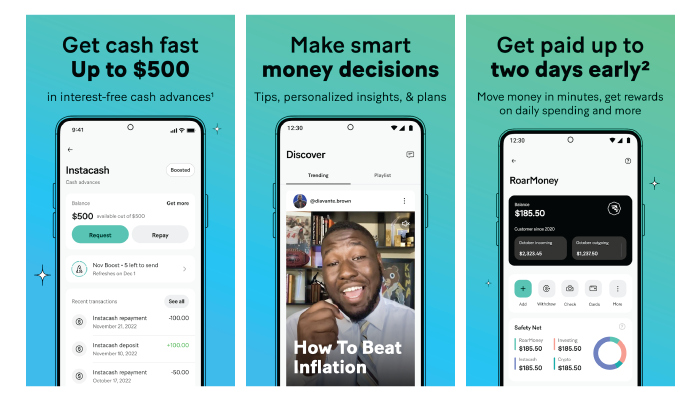

7. MoneyLion – Personal Finance App

Wouldn’t you love it if you had a personal finance guru in your pocket, guiding you towards financial success?

Well, that’s exactly what MoneyLion is.

This financial app combines banking, investing, and personal finance tools into one mighty package.

With features like:

- fee-free checking accounts

- Access to loans

- and investment opportunities

MoneyLion equips you with the tools you need to conquer your financial goals. So, embrace your inner lion and let MoneyLion roar with financial wisdom.

So, these are some of the best mobile banking apps like Revolut! With that out of the way, let’s look at how to develop an app like Revolut in the next chapter.

Conclusion

It goes without saying that apps like Revolut are growing very popular among users as well as investors. This has attracted a lot of investors who want to learn about alternative mobile banking apps.

FAQs

Yes, most of these banking apps, including Revolut alternatives, offer international functionality. It supports multiple currencies, international money transfers, and seamless usage across different countries.

Some of the apps mentioned, such as Revolut and Wise, offer specific features for business banking, including multi-currency accounts, expense management, and integration with accounting software. However, it’s important to review the individual app’s offerings to determine the best fit for your business needs.

While many of these banking apps offer free account options, they may have certain limitations or charge fees for premium features and services. It’s crucial to review the fee structure of each app and consider your banking requirements before making a decision.

Many banking apps allow you to link your existing bank accounts for a consolidated view of your finances. This feature enables you to manage multiple accounts within a single app, making it easier to track transactions and balances.

Some banking apps, such as Revolut, Wise, and N26, have expanded their offerings to include investment options. These may range from basic savings accounts to more advanced investment portfolios. However, it’s essential to review the specific investment features, associated risks, and regulatory aspects before investing through these apps.

Banking apps typically offer customer support through various channels, including in-app chat, email, and phone support. The quality and availability of customer support may vary, so it’s advisable to check the app’s support options and user reviews for insights into their responsiveness.

Most banking apps are designed to be accessible on multiple devices, including smartphones, tablets, and web browsers. This flexibility ensures that you can manage your finances conveniently from any device with an internet connection.

Yes, many of these banking apps support contactless payments through digital wallets like Apple Pay, Google Pay, or their own proprietary solutions. These payment methods enable users to make secure and convenient transactions using their mobile devices.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.