You have a brilliant app idea. Maybe it is a productivity app to help people organize their work, a game that could go viral, or a health app that could improve lives. You have planned out the features, visualized the design, and thought about marketing.

But then reality hits. You don’t have the funds to make it happen. No worries! You are not alone. As per Statista, more than 90% of mobile apps fail to reach their potential audience, and one of the biggest reasons is a lack of funding.

Many startups never get past the idea stage because they do not have enough money to develop, launch, and market their apps. In 2023 alone, venture capital investments in mobile app startups exceeded $50 billion worldwide.

But this money is distributed in a small percentage of startups with proven traction. For first-time founders, the challenge is real: how do you secure funding without giving up too much control, or worse, watching your idea fade away?

This blog will discuss the proven ways to get funding for an app. By the end, you will know exactly how to take your idea from concept to reality.

So, let’s begin!

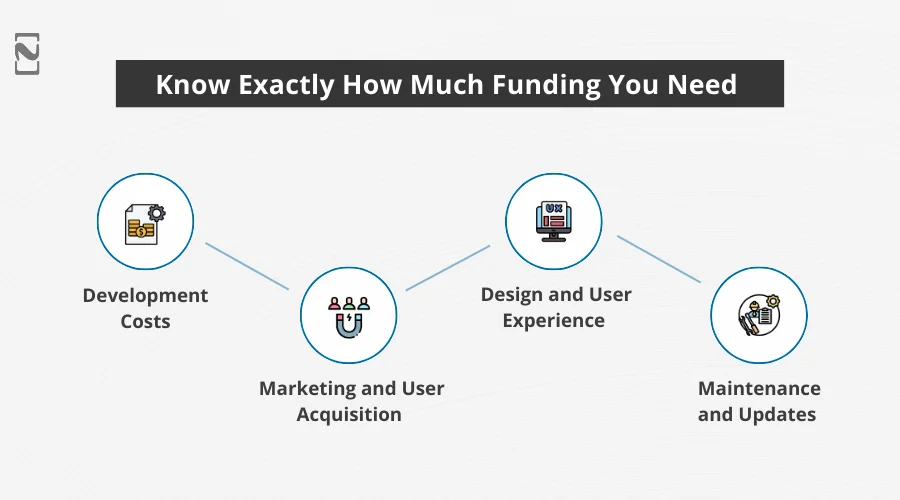

Know Exactly How Much Funding You Need

Before you even consider asking someone else for money, you need to know how much it costs to get your app off the ground.

This step is often overlooked, but it is crucial. Investors and funding platforms want to see a clear plan with numbers, not vague ideas. Here’s how to break it down:

-

Development Costs

The cost to develop an MVP version can range from $15,000 to over $200,000 for a fully-functional app with multiple platforms and custom features. Costs vary depending on whether you hire freelancers, an agency, or build an in-house team.

-

Marketing and User Acquisition

Many startups underestimate this. Acquiring your first 10,000 users can cost $10,000 to $50,000. However, it totally depends on your marketing strategy and competitive landscape.

-

Design and User Experience

Users expect mobile apps to be intuitive and visually appealing. A good design can cost anywhere from $5,000 to $25,000, but it’s worth every penny to increase user retention in mobile apps.

-

Maintenance and Updates

Mobile applications require constant updates, bug fixes, and server maintenance. Experts recommend budgeting 15–20% of your development costs per year for maintenance.

Why Does This Step Matter?

Knowing your funding requirements is not just about numbers. It builds credibility. Investors, friends, or family are far more likely to support your mobile app idea if you can clearly show:

- Where every dollar will go

- What the MVP will include

- How do you plan to reach your first users

Without this clarity, you are risking asking for too much or too little funding, both of which can hurt your chances.

Common Ways to Get Funding for an App

Before raising capital, you should have a clear understanding of the primary funding options available to you. The most common sources to get funding for an app are mentioned below.

1. Bootstrapping: Funding Your App Yourself

Bootstrapping is the classic DIY approach. Many successful applications, like Instagram and Basecamp, started by founders using their own savings to bring their educational or fitness app ideas to life.

The principle is simple. You use your personal resources to fund development and growth without giving up equity or control.

Why Bootstrapping Works:

- You maintain full control over your mobile app and business decisions.

- It forces you to focus on essentials and avoid unnecessary spending.

- Investors often see bootstrapped founders as resourceful and committed.

How much can you invest:

A common approach is to allocate 10-30% of your personal savings toward an MVP. For example, if you have $15,000 in savings, you might spend $10,000 on core development and $5,000 on initial marketing.

Many founders use no-code tools or freelance developers to keep costs low. Sometimes, developing a fully functional MVP for under $5,000.

Tips for successful bootstrapping:

- You should develop an MVP first and focus only on core features.

- Do not overspend even a small amount, as it can cause a tight budget.

- Just make sure your MVP can scale if you secure additional funding later.

2. Friends and Family Funding

If your savings are not enough, friends and family are often the first people to provide funding for an e-wallet app idea. This can be a really fast and flexible way to raise small amounts of capital.

How it works:

Suppose you borrow money from people you trust, and you can offer them a small equity stake in your startup. Although funds are usually smaller, they can range from $5,000 to $50,000. It totally depends on your network’s capacity.

Tips for Success:

- You can draft clear agreements that specify repayment terms or equity shares.

- You can share your budget, goals, and risks.

- You should update them regularly on progress to maintain trust.

Many startup founders start with bootstrapping to test their MVP, then approach friends and family for additional capital if required. This combination reduces risk and validates your app concept before approaching professional investors.

3. Angel Investors

Angel investors are individuals who invest their personal money into early-stage startups. Unlike banks, angels are willing to take risks on new ideas. And especially if they believe in the founder and the market opportunity.

According to the Angel Capital Association, angel investors fund over 70,000 startups every year. They provide more than $25 billion in early-stage capital globally. Many of today’s biggest apps, like WhatsApp and Uber, received angel funding in their early days.

Angel investments generally range from $10,000 to $250,000. This makes them ideal for app startups that have a working MVP, early users, traction, and a clear business model.

How to attract angel investors for your app?

Here is what angels typically look for:

- Your app should solve a real, painful problem.

- Angels invest in people as much as ideas.

- Show that your app can grow beyond a small niche.

- Even 1,000 active users can make a difference.

Tips for Success:

- You can create a 10-12 slide pitch deck that includes the problem, solution, market, traction, revenue, and team.

- Network at startup events, demo days, and online platforms like AngelList.

- You can ask for feedback first, not money. It builds trust.

4. Venture Capital

Venture capital is a funding method that is provided by companies that invest in startups with high growth potential. VCs do not just want a good application. They want a business that can grow fast and generate good returns.

In 2024, mobile and SaaS captured around 40% of worldwide VC funding. This shows a strong investor interest in scalable digital products. For example, they can give funding for fintech apps. VC investments usually start at $500,000 and can go into the millions, but they come with higher expectations.

When does VC funding make sense for an app?

Venture capital is not for everyone. It is best suited when:

- Your mobile app targets a large or fast-growing market

- You already have traction (users, revenue, retention metrics)

- You need capital to grow fast

If your mobile app is a niche tool or a lifestyle business, then venture capital funding may not be the right fit.

How to attract venture capital funding?

Venture capital looks for data-driven proof. Let’s take a look at what they want to see:

- Traction metrics include user retention, monthly active users, and revenue growth

- Scalable business model that covers subscription, in-app purchase, and enterprise plans

- Strong team with technical and business leadership in place

- Clear growth strategy, like how funding will 5x-10x growth

Pros and Cons of Venture Capital

Pros:

- You can get huge amounts of capital

- It gives faster growth and market expansion

- Strategic guidance and connections

Cons:

- Loss of equity and some capital

- Pressure to grow quickly

- High expectations and performance tracking

Angel vs. VC: Which Is Right for You?

If you are still validating your mobile app idea, angel investors are often the better choice. However, if you have a proven demand and want to scale fast, then venture capital may be the right path.

Many successful founders and startups follow this sequence to reduce risk and build credibility at each step.

| Bootstrapping → Angel Investors → Venture Capital |

5. Crowdfunding

Crowdfunding allows you to raise money from a large group of people through online platforms. Instead of pitching to investors, you pitch directly to the public. As per industry reports, successful crowdfunding campaigns raise between $20,000 and $100,000 on average.

Tech products consistently rank among the top-performing categories. For mobile app founders, crowdfunding is often less about the money and more about proving that people want the product.

Types of Crowdfunding for App Startups:

There are mainly 3 types of crowdfunding that are mentioned below:

- Reward-based crowdfunding: Backers receive early access, premium features, or exclusive perks. Some popular reward-based crowdfunding apps are Kickstarter and Indiegogo.

- Equity crowdfunding: These platforms allow backers to own a small share of your startup. It is best suited if you’re open to sharing equity with many small investors.

- Pre-sales model: Users pay upfront for future access. It is very common for productivity, fitness, and SaaS applications.

Why does crowdfunding work for mobile apps?

Crowdfunding works best for mobile apps because of the market validation, built-in marketing, and no traditional investors. In fact, startups that validate demand in advance are 35% more likely to succeed.

How to run a successful crowdfunding campaign?

Crowdfunding is not a post-and-wait. Successful campaigns require preparation. So, you need to know the major elements of winning a campaign. Let’s have a look:

- A clear problem and solution

- A short demo video or clickable prototype

- Simple and compelling storytelling

- Realistic funding goals

- Attractive rewards

Most successful campaigns hit 30% of their goal in the first week. They often use their personal networks and early supporters.

6. Startup Grants and Competitions

Grants are funds provided by the government, non-profits, and innovative programs to support entrepreneurship. Unlike investors, grant providers do not take equity from your company.

Globally, billions of dollars are allocated annually to startup grants. This is particularly true in the technology, healthcare, sustainability, and education sectors.

Where can mobile app founders find grants?

They can find grants in:

- Government innovation grants that focus on digital transformation, AI, health, or education.

- Startup accelerators and incubators that offer small grants plus mentorship.

- Tech and innovation competitions that provide prize money often range from $5,000 to $100,000.

Why are grants worth the effort?

It is because grants do not involve any equity dilution, increase credibility, and provide access to mentorship and industry exposure. Winning or even being shortlisted for a grant can improve your chances of attracting future investors.

How can you improve your chances of getting grants?

Grant applications are competitive, but not impossible. You can follow the best practices that are given below:

- Read eligibility requirements carefully

- You can clearly explain the problem your app solves

- You can show the social or economic impact

- You can include realistic timelines and budgets

However, many funders apply once and quit. For those who apply to multiple programs, their success rates increase significantly.

7. Strategic Partnerships

A strategic partnership is when two businesses collaborate to achieve shared goals. For mobile app startups, this often means working with a company that already serves your target audience. This is considered to be the best way to get funding for an app.

Instead of giving you cash, partners may offer technical support, marketing exposure, distribution access, and revenue-sharing agreements. Startups with strong partnerships grow 2x faster than those operating alone.

Examples of strategic partnerships for an app startup:

These partnerships can reduce your upfront funding needs by 30–50%, especially in marketing and distribution. Let’s have a look at some popular examples.

- Co-marketing partnerships. For example, a fitness app partners with a gym chain to promote the app to members.

- Technology partnerships. For example, a SaaS app integrates with an established platform and gains instant users.

- Revenue sharing deals. For instance, a company funds part of the development in exchange for a share of future revenue.

How to secure strategic partnerships?

You can clearly define how both sides benefit and show how your app adds value to their customers. You can also start with pilot collaborations before long-term commitments.

8. Incubators

Incubators are organizations or firms that support very early-stage startups by providing mentorship, workspace, business support, and sometimes small grants. They focus more on idea validation and early mobile app development rather than rapid scaling.

Why do incubators matter for app founders?

It is because they have access to experienced mentors, reduced development and operational costs, and credibility when approaching investors later. Many startup founders who go through incubators are more likely to survive their first two years compared to those who do not.

9. Accelerators

Accelerators are intense, short-term programs, often 3-6 months. It is designed to assist startups in growing quickly.

In exchange for a small equity stake, accelerators provide seed funding, mentorship from industry experts, and investor demo days. Some very well-known examples are Y Combinator, Techstars, and MassChallenge.

Why are accelerators valuable?

- They have access to top-tier mentors and investors.

- They provide structured growth frameworks and increased investor visibility.

Data shows that accelerator-backed startups raise significantly more follow-on funding than non-accelerated startups. Many founders use all three, accelerators, incubators, and strategic partnerships, at different stages of their app journey.

Pros and Cons of Accelerators:

Pros

- Early funding + guidance

- Strong startup networks

- Faster learning curve

Cons

- Competitive entry process

- Equity dilution

- Time-intensive programs

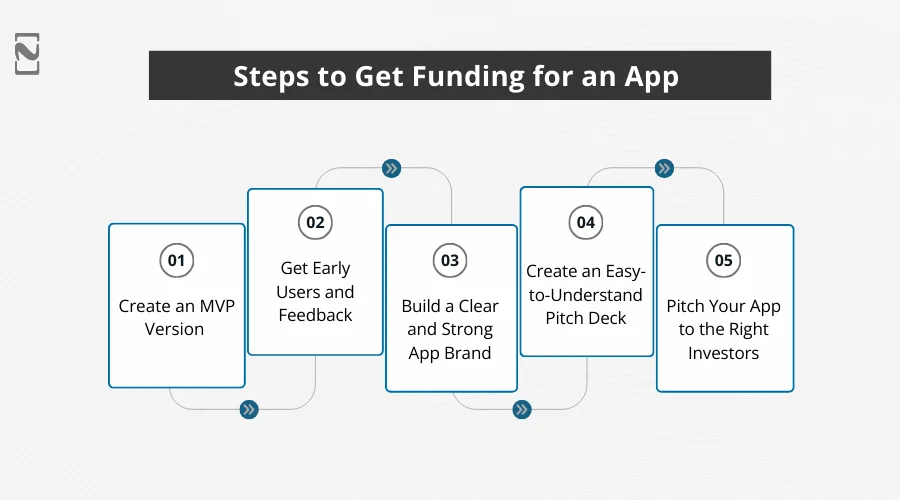

Steps to Get Funding for an App

Building an app is exciting, but finding the money to build it can feel scary. Many app founders stop early because they don’t know how app funding works.

The good news is that getting funding for an app is possible if you follow the right steps. In this section, we will explain the process of getting funding for an app.

Step 1: Create an MVP Version

Before asking for funding, you need something to show. This is called a Minimum Viable Product, or MVP. It is a simple version of your app that shows the main idea. It doesn’t need fancy features, but a simple, basic version with only core features.

An MVP helps investors see that your idea is real and not just a thought. It also helps you test if users actually like your app.

Step 2: Get Early Users and Feedback

After your MVP is ready, start sharing it with real people. These early users help you understand what works and what doesn’t. Their feedback can guide improvements and make your app better.

When investors see that people are already using your mobile app, they trust your idea more. Additionally, even a small number of active users can make a big difference when seeking app funding.

Step 3: Build a Clear and Strong App Brand

Your app needs a strong identity. This includes a simple name, a clean logo, and a clear message about what your app does. A good brand helps people remember your mobile app and trust it.

Investors also pay attention to branding because it shows professionalism. When your app looks serious and focused, it feels more valuable and ready for growth.

Step 4: Create an Easy-to-Understand Pitch Deck

A pitch deck explains your app idea shortly and clearly. It should cover the problem your app solves, who will use it, how it works, and how you plan to make money. Keep it simple and visual.

Investors do not want long stories. They want clear answers. A strong pitch deck increases your chances of getting funding for your app.

Step 5: Pitch Your App to the Right Investors

Once your pitch deck is ready, it’s time to talk to investors. These can be angel investors, startup programs, or venture capital firms. Be confident and honest when explaining your app.

Show your MVP and user growth if you have it. Investors like founders who understand their product well and are open to learning and improving.

How to Prepare a Strong Pitch for App Funding?

Raising money for your app is not just about having a great idea. Many promising mobile app startups fail to secure funding simply because the founder was not ready to explain their business properly. So, in this section, we will focus on how to prepare a strong pitch.

► Start with a Simple but Clear Business Plan

Your business plan does not need to be too long or complicated. What matters is clarity. Investors want to understand what problem your mobile app solves, who it is for, and how it will make money.

If you cannot explain this in simple terms, investors will assume the business itself is unclear. A good business plan outlines your target audience, pricing strategy, and growth approach.

Additionally, it shows that you have thought beyond developing an application and considered how it will serve and scale as a business. Keep your assumptions realistic. Investors prefer honest projections over aggressive numbers that don’t make sense.

► Create a Pitch Deck that tells a Real Story

Most investors review plenty of pitch decks every week. On average, they spend less than three minutes deciding whether to continue the conversation or not. That’s why your pitch deck needs to tell a story quickly and clearly.

Your pitch deck should explain why the problem matters, why your solution is better than existing options, and why your app is required right now. Additionally, you should avoid long paragraphs and crowded slides.

Each slide should communicate one idea. You can think of your pitch deck as a conversation starter. It is not a full explanation. If you are clear and engaging, investors will ask questions.

► Understand your Numbers before Anyone Asks

Now, one of the fastest ways to lose credibility is not knowing your own numbers. Investors expect you to understand your mobile app development costs, monthly expenses, and how long your funding will last.

If your app is already live, they will ask about users, growth, and retention. You don’t need perfect data at an early stage, but you do need logic behind your estimates.

Being comfortable with numbers shows that you can manage money responsibly. Investors are not just funding your app. They are trusting you with their capital.

► Show Progress through an MVP or Prototype

Mobile app ideas are cheap. Execution is what investors care about. A working MVP, prototype, or clickable demo improves your chances of getting funded. It shows that you can turn ideas into reality. Your MVP doesn’t need to be perfect.

It just needs to demonstrate the core value of your app. Early user feedback, beta testers, or sign-ups add more credibility. Investors are more confident in funding startups that have already taken action rather than those still stuck in planning mode.

Why Startups Choose Nimble AppGenie for Creating Scalable Mobile Apps?

Nimble AppGenie works closely with startups to turn app ideas into top-notch mobile solutions. We support founders from the earliest idea stage through MVP development and long-term growth.

Being an experienced mobile app development company, we focus on developing cutting-edge and visually appealing applications that are ready for users. Startups choose us for our practical, startup-friendly approach.

Additionally, we help validate ideas, build prototypes, and build an MVP that reduces risk and development costs. With flexible engagement models and clear development roadmaps, founders stay in control while moving fast.

Besides, we help startups prepare for growth with investor-ready prototypes, clear technical documentation, and scalable architecture. With experience across multiple industries, Nimble AppGenie helps startups launch faster and grow with confidence.

Conclusion

Securing funding for an app idea is not about chasing every option. It is about choosing what fits your goals and stage of growth. From bootstrapping to angel investors, each funding route has its own pros and cons.

Many successful founders start by understanding their costs, validating their ideas, and developing a solid MVP. But funding is not enough. Execution matters just as much. Thus, now is the perfect time to take action.

Just prepare your budget, refine your pitch, and choose the funding strategy that aligns best with your vision. The right preparation can turn our app idea into a successful business.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.