With the rapid shift in digital space, the finance and banking sector is evolving, and simultaneously, the entire ecosystem, embracing FinTech platforms, neobanks, and API-based banking, has basically reshaped how financial services are delivered.

Now, institutions demand round-the-clock service availability, real-time responsiveness, and a smooth user experience.

Thus, compliance teams, customer service departments, and operational infrastructure are under extreme pressure to process elevated transaction volumes, client requests, and regulatory checks at reduced cost and with ultimate precision.

Here, Robotic Process Automation (RPA, full form in finance), becomes operative, providing a critical response to such requirements.

Robotic Process Automation (RPA) supports organizations in automating rule-based, repetitive, and high-volume tasks by software “robots” or “bots” deployment that mimic human connections with systems when programmed to conduct a task series.

Whether you are a CFO, finance manager, finance operations team, RPA CoE/Automation Lead, CIO/IT director, RPA Developers, or Compliance & Audit Teams, adopt RPA solutions or implement RPA in finance to speed up month-end closing, diminish risks of human errors and fraud, and make your team free for strategic decision-making.

This post talks about robotic process automation in finance, the benefits, how to implement RPA in finance, use cases, and everything you need to know for seamless integration of RPA in your business.

Let’s get started!

What Is Robotic Process Automation (RPA) in Finance?

In this section, let’s get deeper into knowing the RPA meaning in finance.

The robotic process automation in finance streamlines repetitive tasks, such as account opening, data entry, customer support, compliance checks, and transaction processing.

Acting like virtual assistants, RPA finance software bots mimic human interactions by updating records, managing data, validating information, operating with applications, communicating with other systems, generating reports with accuracy, and following rules.

So forth, businesses choose RPA for finance and accounting to mitigate operational risk, boost efficiency, ensure ongoing compliance, and accelerate internal operations.

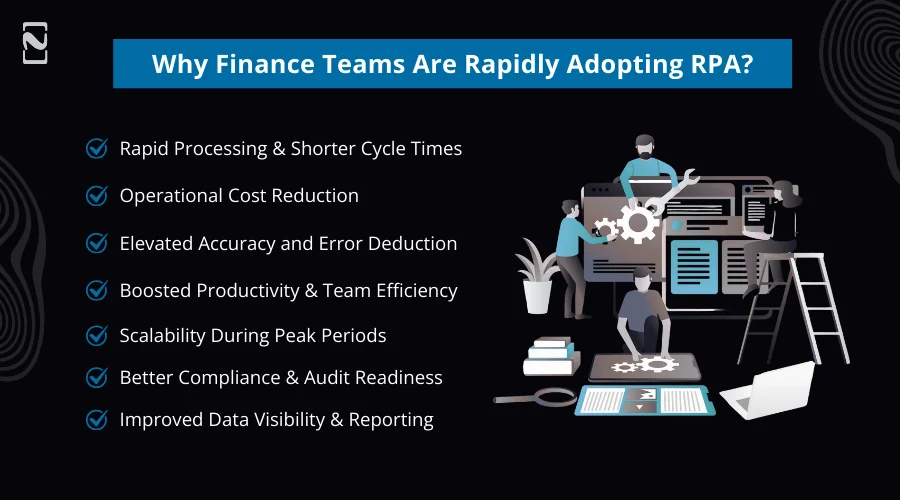

Why Finance Teams Are Rapidly Adopting RPA – Key Benefits of RPA in Finance

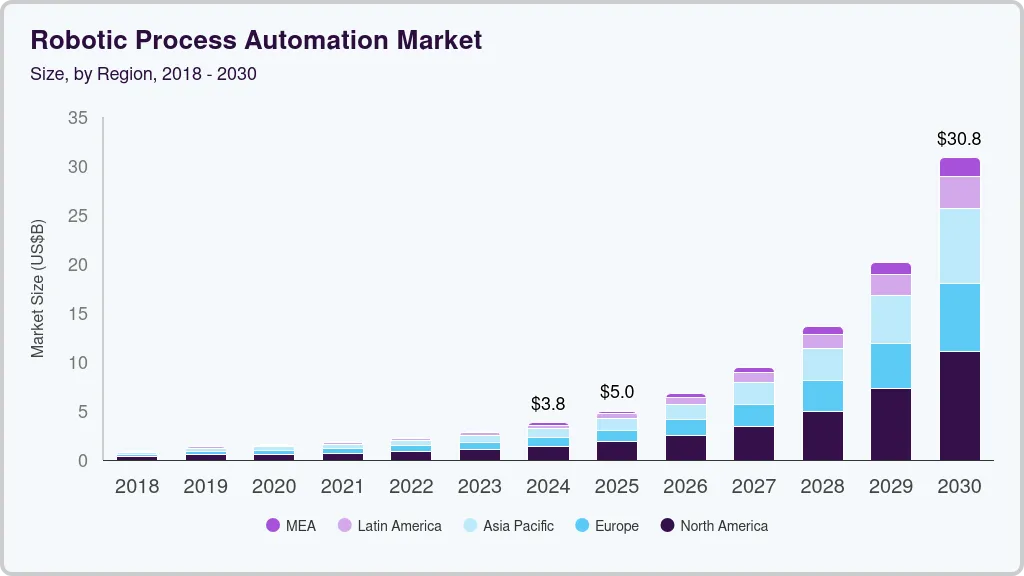

Did you know the global robotic process automation market valuation is surging and anticipated to reach $30.85 billion by 2030, at a CAGR of 43.9%?

Why is the demand for RPA in the finance market surging?

Obviously, it’s because of the numerous benefits of RPA in accounting and finance that raise the need for transformation from operational jobs to strategic decision-making.

-

Rapid Processing & Shorter Cycle Times

RPA bots conduct financial workflows, such as Accounts Receivable, Accounts Payable, reconciliations, and reporting in minutes, not hours, which notably pace up monthly and quarterly closing cycles.

-

Operational Cost Reduction

RPA implementation helps finance teams automate high-volume tasks, mitigate processing costs, scale operations, and reduce dependency on temporary resources without even increasing headcount.

-

Elevated Accuracy and Error Deduction

With robotic process automation bots, you can ensure constant validations, eradicate manual data-entry blunders, and keep up financial data across systems.

-

Boosted Productivity & Team Efficiency

Financial staff leverage the power of RPA to focus on predictions, analysis, and value-oriented tasks rather than on redundant administrative work.

-

Scalability During Peak Periods

Be it quarter-end, month-end, sudden volume spikes, or tax season, RPA bots make it simple to handle as they hold the caliber to scale promptly without adding extra manpower.

-

Better Compliance & Audit Readiness

For every action, RPA helps create trackable logs, timestamped, that make SOX readiness, compliance, and internal audits simpler and reliable.

-

Improved Data Visibility & Reporting

Bots extract, consolidate, and validate financial data from various systems, leading to more precise and timely reports.

RPA vs. Bot vs. Automation in Finance

Finance departments usually mix up the terms automation, RPA, and bots. But all have distinct meanings and purposes.

Below, we have a simple explanation of each to allow you to understand easily.

Comparison Table: RPA vs. Bot vs. Automation in Finance

| Aspect | Automation | RPA | Bot |

| Definition | Any type of tech-enabled automation | Rule-based task automation using software robots | The automated script/robot performing the task |

| Scope | Broad (ERP workflows, AI, scripts, and APIs) | Narrow and task-specific | Very narrow (single task or workflow) |

| Intelligence | Can include AI/ML | Limited to rules | No intelligence, just follows set instructions |

| Usage in Finance | Workflow approvals, alerts, and predictions | Invoice processing, reconciliations | Extracting data, clicking, and copying/pasting |

| Human Replacement Level | Partial | Task-level replacement | Step-level replacement |

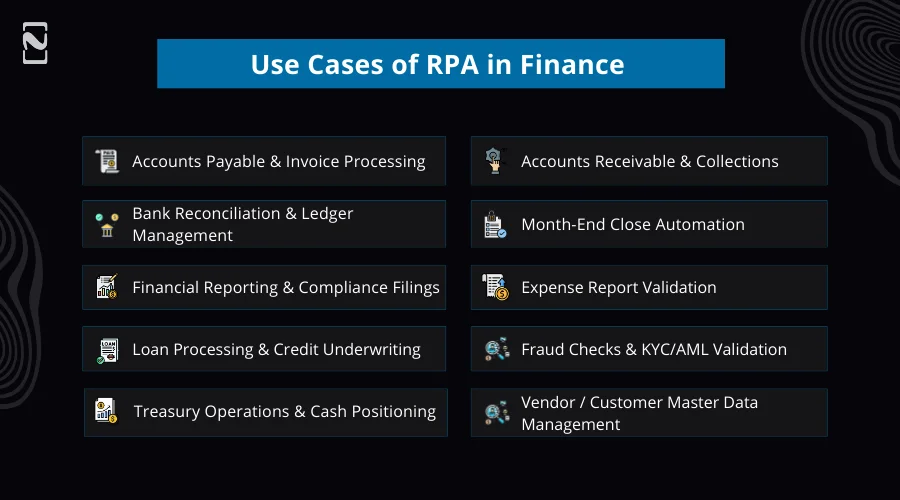

Use Cases of RPA in Finance

Numerous tasks in finance are prone to human error, result in inefficiencies, and jam up the workflows.

Finance leaders who are well aware of the impact of RPA in finance use an RPA platform powered by the latest technologies.

Below, we will uncover the role of RPA in finance use cases.

1] Accounts Payable & Invoice Processing

Accounts payable automation helps you accelerate payments and eliminate manual roles, thanks to RPA bots that streamline invoice data extraction, amount validation, ERP systems updates, and purchase orders matching.

The invoice processing automation leads to faster, accurate, and consistent outcomes.

2] Accounts Receivable & Collections

Bots are the true companions of finance managers today who look for improved cash flows. They strengthen companies, update customer ledgers, send payment reminders, generate collection reports, and track overdue invoices.

You save time on information filling and payments tracking, and leave no margin for error, which is caused by incorrect record entry.

3] Bank Reconciliation & Ledger Management

Regardless of the size of your financial institution, account reconciliation holds importance as it involves the comparative study of external statements and internal account balances.

Doubtlessly, it’s time-consuming, but inevitable at the same time.

Here, Robotic Process Automation (RPA) solutions walk in for finance reconciliation automation with quick records comparison, fraud spotting, mismatch flagging, and instant ledger updates.

This reduces hours of reconciliation to minutes.

4] Month-End Close Automation

Most of the time, the finance teams find it challenging to accomplish the closing process rapidly, boost efficiency, and enhance accuracy.

Bots’ adoption increases at this point to automate financial data gathering, balance reconciliation, journal preparation, and entries validation.

Thus, with financial close automation, you can witness your month-end closing smoother and error-free.

5] Financial Reporting & Compliance Filings

The Banking, Financial Services, and Insurance (BFSI) industry is highly regulated worldwide.

Banks should frequently calculate expected credit loss (ECL), conduct post-trade compliance checks, and make thorough reports.

Besides, compliance officers have to give 15% of their time to tracking modifications in regulatory needs.

By opting for Finance robotic process automation bots, the sector automatically accumulates data from separate sources, embracing federal bodies and government websites.

Next, through bots, they input the gathered information into the internal systems following the relevant guidelines.

So forth, banks ensure compliant, on-time financial reporting.

6] Expense Report Validation

Being a critical practice, instead of an administrative job, expense report validation supports the business’s strategic decision-making and complete financial health.

One of the core RPA use cases in finance demands bots to review receipts, check expense claims, verify policy compliance, and approve.

Consequently, you can diminish fraud and accelerate employee reimbursements.

7] Loan Processing & Credit Underwriting

Every bank focuses on one of the most essential areas, mortgage lending, which is a process-based service, yet laborious.

Banks get overwhelmed with various loan-lending-relevant operations, like quality checks, document processing, and credit arrangement.

RPA helps with swift loan request processing by retrieving customer documents, credit score checks, details verifications, and form filling.

This makes loan approvals faster and more precise.

8] Fraud Checks & KYC/AML Validation

Financial institutions look for sure-shot ways to avoid financial crime, safeguard their reputation, and ensure financial regulatory compliance to stay away from the risks, like heavy fines and financial losses.

Banks leverage the potency of RPA to screen transactions, validate customer identity, review documents, and stop suspicious activities.

Thus, help the finance companies to prevent fraud, supporting their compliance teams.

9] Treasury Operations & Cash Positioning

For your business’s agility, stability, and overall financial health, treasury operations and cash positioning are important, which ensure you have enough cash to fulfill prompt operational requirements while utilizing excess funds calculatedly.

By adopting RPA in finance operations, you can pull real-time financial data, predict liquidity, update cash positions, and reinforce treasury decision-making.

Hence, robotic process automation in finance enhances cash management.

10] Vendor / Customer Master Data Management

When you need to create a sole, reliable source of truth across your organization for all suppliers’ and clients’ information, Vendor / Customer Master Data Management is required.

RPA bots come to play by creating, updating, and validating master records, eliminating duplicates, and ensuring precise data.

Therefore, you can keep financial systems reliable and clean.

Examples of RPA in Banking

The finance process automation is in demand post various companies accelerated their operations, diminished costs, and improved user experiences by choosing RPA in the finance industry.

Let’s talk about the top organizations that are leading the pack in fintech and accounting automation with RPA:

Case Study 1: UiPath at Citibank

Citibank connected with UiPath for RPA deployment in their finance and accounting departments to automate repetitive jobs, like payment processing, invoice matching, and bank reconciliation.

Results Achieved:

- Reduced errors,

- Increased accuracy,

- Boosted processing speed,

- Handled increased financial transaction volumes, and

- Mitigated labor costs (of manual processing and staff redeployment for more valued tasks).

Case Study 2: HSBC – Automating Trade Finance Operations

HSBC picked RPA in trade finance for document verification and validation automation.

By implementing RPA in finance, the bank verified data against contracts, smoothed the shipping documents review, and ensured regulatory standards compliance, which led to accelerated processing time and reduced manual work.

Results Achieved:

- Saved costs,

- Boosted accuracy,

- Diminished manual labor,

- Diminished costly mistakes,

- More precise transactions, and

- Elevated efficiency with 70% reduced processing time,

These are just two examples of RPA in finance; there are more names in the list of banks, fintechs, and insurers that are harnessing the caliber of RPA.

JPMorgan Chase, Sumitomo Mitsui, Danske Bank, Axis Bank, and more are more RPA examples in finance, ruling the market.

Yes, you are going right, choose banking app development or integrate RPA in your business to reap the rewards of the best RPA tools for finance teams.

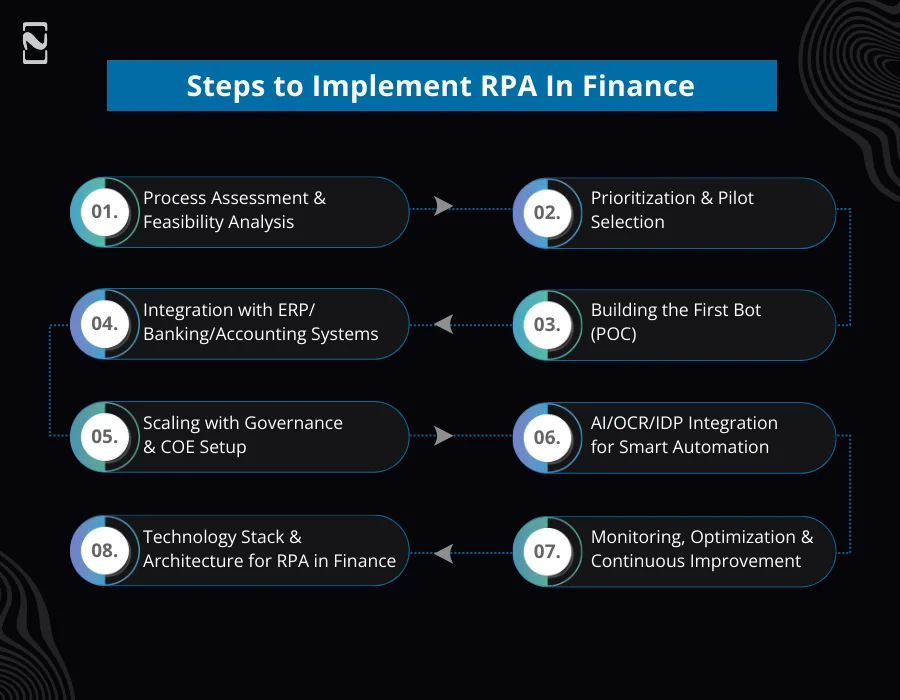

Steps to Implement RPA In Finance

Timely and strategic RPA implementation can save you time and provide cost benefits for finance and admin teams as well as the entire business.

How to implement RPA in finance?

Here, we will discuss the steps for a successful implementation.

Step 1: Process Assessment & Feasibility Analysis

What Is It: First, you should start by examining your current financial processes to identify redundant or rule-based tasks that are useful for RPA candidates.

Key Activities: Process mapping, stakeholder interviews, volume & exception analysis, and technical feasibility check.

Outputs: You witness prioritized process inventory, estimated effort, a feasibility report, and benefit per process.

Success Check: A transparent list of 8 to 12 candidate processes with automation complexity and predicted ROI.

Step 2: Prioritization & Pilot Selection

What Is It: Next, you must pick the process you want to pilot based on risk, ease of automation, and impact.

Key Activities: Select pilot owner, apply scoring (impact × effort), and define success metrics, including errors, cost, and TAT.

Outputs: You get a pilot charter, timeline, success KPIs, and sponsor sign-off.

Success Check: Pilot chosen with measurable KPIs and executive buy-in.

Step 3: Building the First Bot (POC)

What Is It: Now, you need to build a working bot for validating assumptions and revealing measurable value.

Key Activities: Design bot workflow, create & unit test bot, execute controlled user acceptance tests, and iterate.

Outputs: POC bot, UAT sign-off, test logs, and lessons-learned document.

Success Check: The bot satisfies KPIs in the test environment and functions reliably on sample real transactions.

Step 4: Integration with ERP/Banking/Accounting Systems

What Is It: In this step, connect your bot to key systems, like bank portals, ERP, and accounting software, reliably and securely.

Key Activities: Opt for the integration method, implement error handling, retries, and set up credentials.

Outputs: Secure connection configurations, role-based access controls, and integration runbooks.

Success Check: RPA bot reads/writes to target systems with no manual intervention and logs all actions.

Step 5: Scaling with Governance & COE Setup

What Is It: Now, it’s time to switch from a pilot to an enterprise program with teams, controls, and standardized processes.

Key Activities: Define standards (versioning, naming, and documentation), form CoE, change management, and training.

Outputs: CoE charter, deployment pipeline, automation standards, and SLA/operational support model.

Success Check: Tracked SLAs, reproducible deployment process, and constant pipeline of prioritized automations.

Step 6: AI/OCR/IDP Integration for Smart Automation

What Is It: Ahead, you should add intelligence to manage exceptions and unstructured data through document understanding and ML models.

Key Activities: Train extraction models, select OCR/IDP provider, include human-in-the-loop processes, and integrate confidence thresholds.

Outputs: Downsized manual exceptions, structured data from documents, and model performance metrics.

Success Check: Documents auto-processed beyond confidence threshold and a decrease in manual review volume.

Step 7: Monitoring, Optimization & Continuous Improvement

What Is It: Now, you should run your bots in production, analyze performance, catch exceptions, and enhance processes with time.

Key Activities: Alerting, implementing dashboards, periodic bot health checks, optimization sprints, and root-cause inspection of failures.

Outputs: SLA reports, performance dashboard, and backlog of optimizations.

Success Check: Reduced exception rates, stable or enhancing bot uptime, and quicker processing times.

Step 8: Technology Stack & Architecture for RPA in Finance

What Is It: Lastly, it is time to clarify the end-to-end tech architecture that fortifies scalable and secure automation.

Key Components: RPA platform, IDP/OCR, orchestration server, integration middleware or APIs, secure credential vault, logging & monitoring, and analytics layer.

Outputs: Component responsibilities, architecture diagram, security controls, and disaster recovery plan.

Success Check: Secure secrets management, centralized monitoring, and architecture support scaling to multiple bots.

Challenges of RPA Implementation in Finance

The adoption of RPA in FinTech doesn’t come without challenges.

You have to deal with cybersecurity concerns, integrate RPA with legacy systems smoothly, and more.

Below, let’s put forth the major challenges you can encounter while you integrate RPA with possible solutions:

Challenge 1: Unstructured & Inconsistent Financial Data

You can’t succeed with finance processes in inconsistent formats, like bank statements, receipts, invoices, and PDFs that are not in a consistent format.

Solution: OCR and IDP (Intelligent Document Processing) are best for the smooth extraction of structured data.

Besides, validate rules and create human-in-the-loop checks for doubtful fields.

Challenge 2: High Exceptions & Complex Scenarios

Finance workflows usually demand manual approvals, decision rules, and exceptions.

Solution: You can redesign workflows before streamlining processes, build exception-handling logic, leverage ML-based decision models on a requirement basis, and allocate escalations to users.

Challenge 3: Frequent Process & System Changes

While RPA bots are working, the UI changes in banking, accounting, or ERP portals break progress easily.

Solution: Go for API integrations instead of UI automation, handle bot runbooks, implement version control, and plan periodic bot health checks.

Challenge 4: Lack of Process Standardization

If RPA implementation steps vary by region, user, or team, bots fail to follow transparent rules.

Solution: Define rule sets, standardize SOPs, remove repeated steps, and merge naming conventions before you build the RPA bot.

Challenge 5: Security & Compliance Risks

As bots access sensitive financial systems and data, the chances of breaches or misuse are high.

Solution: Businesses should utilize RBAC, credential vaults, audit trails, encrypted logs, and allow bot architecture to follow SOX/PCI/ISO security guidelines.

Challenge 6: Poor Stakeholder Buy-In

IT, Finance, and compliance teams usually resist automation or prefer operating in silos.

Solution: Provide proper training, conduct workshops, clarify roles, communicate ROI, and reveal early wins with an impactful pilot.

Challenge 7: Scaling Beyond Pilot Automation

Because of the weak regulations, various companies get confused after including just 1 or 2 bots.

Solution: You should create reusable components, set up a Finance RPA CoE, define development standards, and automate deployment through CI/CD.

Challenge 8: Gauging ROI & Impact

Many finance teams find it hard to track operational advantages or justify automation pricing.

Solution: Businesses must use dashboards, define KPIs upfront (FTE savings, TAT, compliance improvements, and accuracy), and weekly compare pre- vs post-automation metrics.

Challenge 9: Hidden Maintenance Effort

Whenever you change forms or data rules, robotic process automation (RPA) bots demand updates, which is generally underestimated.

Solution: Finance teams should schedule dedicated maintenance cycles, reap the benefits of monitoring dashboards, adopt a modular design, and track failures to diminish update overhead.

Challenge 10: Addressing High Transaction Volumes

Bots can be flooded with month-end and year-end workloads if they don’t have enough capability and can’t scale.

Solution: The financial institutions should choose RPA orchestrators that hold the caliber for queue management, auto-scaling, workload prioritization, and load balancing during peak cycles.

Cost of RPA in Finance & Expected ROI

How much does RPA cost for finance teams?

The cost of implementing RPA in banking and finance relies on the process complexity, scaling needs, bot type, and platform.

Below, we have curated a table with a thorough study on the cost components with an expected range:

RPA Cost Breakdown for Finance Teams

| Cost Component | Details | Typical Range |

| RPA Licensing | Annual license for attended/unattended bots | $5,000 – $20,000 per bot/year |

| Bot Development | Design, build, test & deploy | Simple: $3,000 – $10,000; Medium: $10,000 – $25,000; Complex: $25,000 – $60,000+ |

| OCR / IDP Tools | For invoices, receipts, PDFs, and statements | $1,000 – $15,000 |

| Orchestrator / Control Room | Scheduling, monitoring, and queueing | $3,000 – $15,000/year |

| Integration Costs | ERP, banking, and accounting system integrations | $5,000 – $30,000 |

| Maintenance & Support | Updates, bug fixes, and optimizations | 15–25% of the build cost/year |

| Training & Change Management | Upskilling finance & IT teams | $2,000 – $10,000 |

Now, let’s unveil the ROI estimates you can expect by integrating RPA in corporate finance and other sectors.

Expected ROI from RPA in Finance

| ROI Metric | Expected Improvement |

| Cost Savings | $100,000 – $400,000/year (for mid-sized teams) |

| FTE Productivity Gain | 30–70% workload reduction |

| Processing Speed | 3× to 10× faster processing |

| Error Reduction | Up to 90% fewer manual errors |

| Compliance Accuracy | 100% audit trails; reduced regulatory risk |

| Month-End Close Cycle | 20–50% faster |

| Customer/Vendor Resolution Time | 25–60% faster |

RPA and AI in Finance: The Future of Intelligent Automation

Robotic Process Automation (RPA) and Artificial Intelligence (AI) in finance are unifying to create Intelligent Automation (IA) that can manage rule-based tasks and judgment-based decisions.

AI and RPA in finance are facilitating moving finance into a contactless, predictive, and real-time function.

| Technology | What It Does | Example in Finance |

| RPA (Robotic Process Automation) | Automates repetitive and rule-driven tasks | Invoice data entry, reconciliations, and report generation |

| AI / Machine Learning | Learns patterns, makes predictions, and handles unstructured data | Fraud detection, credit scoring, and risk modeling |

| OCR / IDP | Extracts data from PDFs, invoices, and scanned documents | Automated AP processing |

| NLP | Understands and processes text | Reading emails, extracting transaction details |

| GenAI | Generates insights, explanations, and summaries | Auto-generating financial reports |

How Nimble AppGenie Can Help Implement RPA in Finance?

Being a leading fintech app development company, Nimble AppGenie helps with RPA consulting for accounting teams on how to leverage the power of tailored RPA solutions to shift from error-prone operations to intelligent automation.

We provide RPA implementation services for finance, incorporating a complete cycle, from pinpointing automation opportunities to deploying enterprise-grade bots.

We also help integrate RPA with your banking, ERP, and accounting systems to streamline your finance operations.

Highlights of Choosing Us for RPA Implementation in Finance:

- End-to-End RPA Consulting for Finance

- Integration With Your Finance Tech Stack

- Building Custom Finance Bots

- AI + OCR + IDP for Smart Automation

- RPA COE Setup & Scaling Support

- Governance, Security & Compliance-Driven Automation

- Ongoing Monitoring, Maintenance & Optimization

- RPA COE Setup & Scaling Support

Real-Time Case Study – How a Mid-Sized Financial Services Firm Streamlined 65% of Its Finance Operations Using RPA

Client Overview:

A mid-sized company with 2500+ employees offers wealth management, lending, and investment services. Their finance teams emerged with compliance challenges and operational delays while managing transactional activities.

Challenge:

- Slow Accounts Payable (AP) Cycle

- Time-Consuming Bank Reconciliation

- Month-End Close Delays

- Compliance Gaps

RPA Solution We Offered:

- Phase 1 – Process Assessment & Pilot Setup

- Phase 2 – Automation Rollout

ROI Achieved:

- 65% of automated finance processes

- 5 times increased ROI in the first year

- $420,000 annual savings

- 24/7 bot availability (zero downtime)

Client Feedback:

“RPA transformed the way our finance team works. Nimble AppGenie helped us eliminate bottlenecks, improve close cycles, and strengthen our compliance posture.” – CFO, Financial Services Firm.

Conclusion

Right now, RPA in finance is best for cost-saving, control, and better accuracy.

When combined with advanced technologies like artificial intelligence (AI) and machine learning (ML), finance process automation can help companies boost efficiency and employee productivity.

We can say that full-fledged adoption of RPA in finance is essential in the fintech industry.

Partner with a Fintech development company to get assistance for RPA implementation, RPA solution development, or integrating RPA with your systems.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.